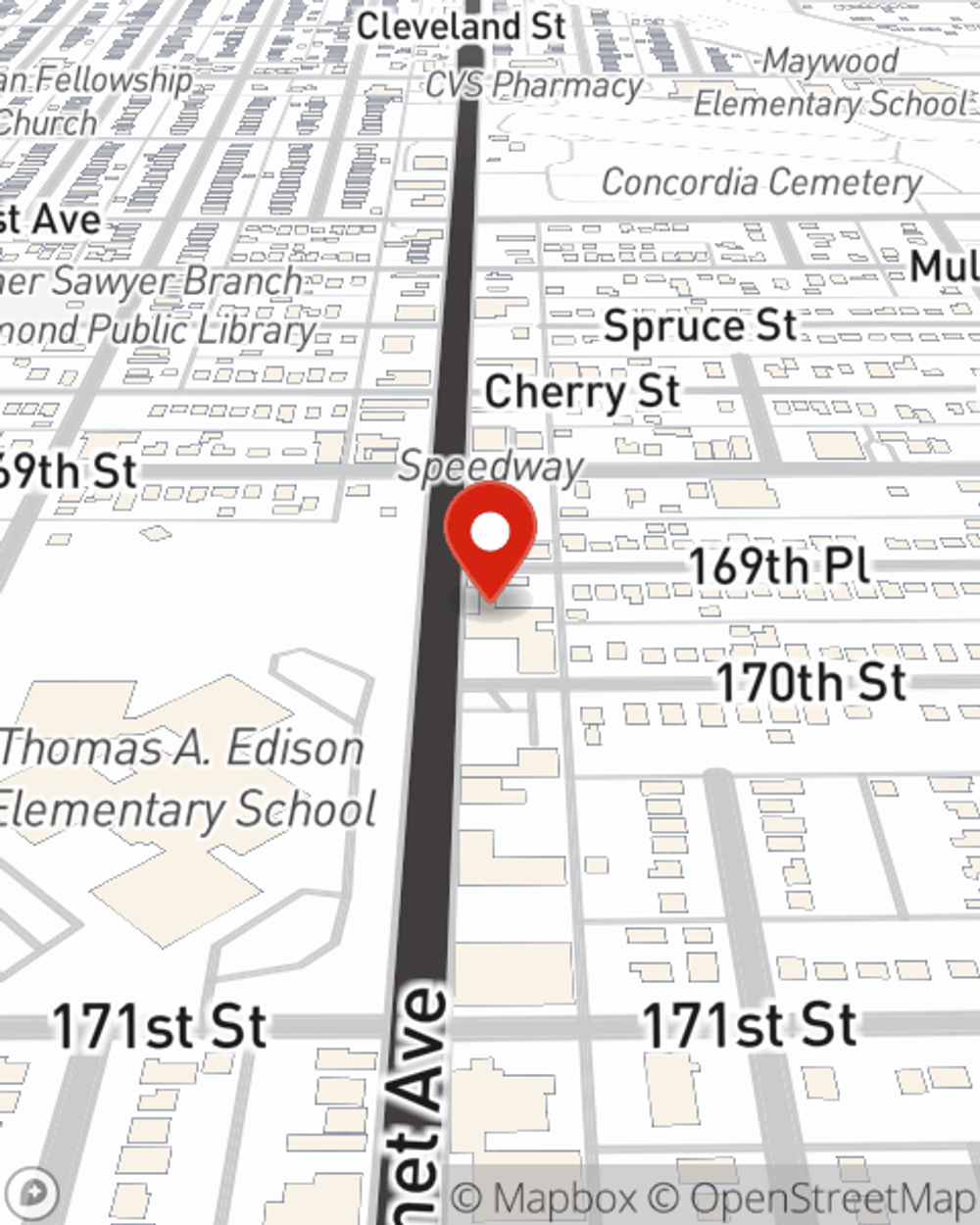

Business Insurance in and around Hammond

Hammond! Look no further for small business insurance.

Insure your business, intentionally

- Lake County, IN

- Cook County, IL

- Porter County, IN

- Hammond, IN

- Munster, IN

- East Chicago,IN

- Crown Point, IN

- Lansing, IL

- Calumet City, IL

- Highland, IN

- Griffith, IN

- Gary, IN

- South Holland, IN

- Dyer, IN

- Schererville,IN

- Merrillville, IN

Coverage With State Farm Can Help Your Small Business.

Whether you own a a lawn care service, a pharmacy, or a window treatment store, State Farm has small business insurance that can help. That way, amid all the different decisions and moving pieces, you can focus on making this adventure a success.

Hammond! Look no further for small business insurance.

Insure your business, intentionally

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, artisan and service contractors or surety and fidelity bonds.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Scott Angel is here to help you identify your options. Get in touch today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Scott Angel

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.